Impact Investing Report

Deploying Philanthropic Capital in New Ways

August 2023

Impact Investing at the Federation

Impact investing can take many forms, all with the overarching goal to create positive change while also earning financial returns. At the Federation, we focus on impact lending, a strategy ideally suited to our funds that are designated for charitable use.

As the Bay Area’s center for Jewish philanthropy, we started our Impact Lending program in the early days of the pandemic by loaning capital to fund desperately needed zero-interest loans for the Northern California Jewish community. Since then, we have expanded our lending across a range of impact areas that reflect our shared Jewish values and the philanthropic interests of our donors.

In its second full year, our Impact Lending program is providing new ways for philanthropic capital to become a catalyst for change. As one of the largest community foundations in California and an innovative leader in the national Jewish philanthropy ecosystem, we now support a host of issues from affordable housing and clean water access to job skills training and financing for nonprofits.

Our community of philanthropists is challenging the conventional invest-and-hold paradigm for philanthropic capital and embracing a true impact-first mentality. We lend through mission-driven organizations that are championing a more inclusive economy by stepping in where traditional financial services fall short.

What is Impact Lending?

Impact loans from philanthropic funds allow low-cost capital to flow to mission-driven financial institutions. These community-centered lenders offer fair and affordable credit to underserved borrowers who often are not served by mainstream banks.

For each loan, we pool capital from multiple Federation funds to create a meaningful investment. Loan capital is expected to be returned to the funds at the end of the specified term and can then be redeployed for grants or other impact loans. Pooling and recycling philanthropic capital amplifies impact by stretching each dollar to its fullest potential.

Over $40 Million at Work

Since 2019, Federation funds have loaned more than $40 million to 18 mission-based financial groups which focus on issues including affordable housing, supporting good jobs and economic development, access to quality education, and more. We offer curated opportunities to loan philanthropic capital to trusted community-based lenders in the U.S. and Israel. These organizations are at the forefront of fostering a stronger, more inclusive economy by lending where traditional financial services fall short.

Impact Themes* in Our Portfolio

$22,133,625

- Access to fair and affordable financial services for underserved populations

- Training for good jobs and economic development

- Small business support in Israel through KIEDF & Ogen

$10,061,700

- Zero-interest loas across Northern Califonia through Hebrew Free Loan

- Access to fair, affordable credit for small businesses in Israel

- Micro-lending and business support in Israel's mixed cities

$4,419,250

- Residential stability

- Housing affordability

- Access to supportive services

- Jewish co-housing through Berkeley Moshav

$1,716,750

- Job skill development for future employment

- Access to quality jobs

- Growth in earnings and wealth through employment and entrepreneurship (particularly for disadvantaged groups)

$1,189,250

- Increased effectiveness and future sustainability of nonprofit organizations

$950,000

- Quality of teaching and learning environments

- Equitable access to education

- Support for The Brandeis School of San Francisco

$853,000

- Improving financial health of farmers

- Increasing access to agricultural training and information

$606,625

- Improving water infrastructure and management

- Access to clean drinking water

*Impact Themes align with the IRIS+ Thematic Taxonomy, developed by the Global Impact Investing Network (GIIN).

Collective Outcomes from Our Community Lenders

% of all loans that were made to women*

% of all loans that were made to People of Color*

Impact data is based on combined reporting provided by all mission-driven financial organizations in our portfolio.

For more information about individual organizations and their respective impact, visit our Reports Library.

*Percentage calculated based on organizations reporting this information.

Investing in Their Community:

The Blackstone Brody Family

Alan Brody and his wife, Hilary, were walking their 5-month-old baby near their home when they came upon a neighborhood beauty salon. Ordinarily, Alan would have just kept walking, but this time, he paused and saw it in a new light. He recognized the bustling salon as one of many Bay Area businesses that had received a loan from a community lender supported by the Federation’s impact loan program. This loan kept the salon afloat during the height of the pandemic. A feeling of pride swept over him. Alan and Hilary have been utilizing their donor-advised Fund (DAF) to help fund the program since 2021, but on this day, they saw the program’s impact firsthand.

The Blackstone Brody family view their DAF and the Impact Lending program as vehicles to express their Jewish values of tzedakah (giving with just intention) and tzedek (pursuing justice), placing a particular emphasis on local issues, hunger, and the housing crisis. Knowing that the program they support is making such a substantive difference right around the corner—at the intersection of their Jewish values and their community—is immensely gratifying for Alan and Hilary.

Mobilizing DAF capital through impact lending allows the family to build community—or kehillah—and fulfill their ongoing philanthropy goals.

“Using our DAF to make an impact loan reconciled the disconnect we had between the money that has been designated for philanthropy and the money that is being held in donor-advised funds. We feel that the money is obligated towards those who need it instead of being warehoused in a stock portfolio.”

Expanding Our Reach

USA outside California

$19,140,875

Bay Area & California

$18,280,325

Israel

$4,199,000

Investing in Israeli Financial Inclusion

Israeli society is made up of a multitude of diverse communities, cultures, and nationalities, with parallel but disconnected lives and varying degrees of access to education, employment opportunities, and financial services. Non-Jewish and low-income Israelis in particular lack business and technical knowledge and face barriers to obtaining fair credit, all of which limits their economic potential.

Our impact loans build on the Federation’s long standing commitment to Israeli organizations working to make the social structure in Israel more equitable and integrated. We prioritize working with organizations that represent all facets of Israeli society and forge relationships based on mutual commitment and ownership of a shared future. Our impact loans in Israel focus on economic inclusion, employment opportunity, and supporting vital small and micro-businesses.

Crafting Connections through Entrepreneurship

KIEDF Mixed Cities program

Rozin, a successful dress designer in one of Israel’s mixed cities*, looked to expand her business by opening a unique boutique offering evening gowns, bridal clothes, and wedding dresses for sale and rental. Unable to secure a bank loan due to conservative credit requirements in the Israeli banking industry, she turned to KIEDF and secured a ₪50,000 loan. Combined with her savings, the loan enabled her to open her store and build a thriving business that brings joy and confidence to women in her community and beyond. Through her creations, she helps people look and feel their best during life’s important moments. Rozin’s story is just one example of how our funding is bringing economic opportunity to the Israeli periphery.

KIEDF’s non-bank loans are designed to strengthen communities and promote cooperation and harmonious coexistence by investing in businesses that bring jobs and much-needed products and services to Jewish and Arab populations in Israel’s mixed cities.

* Cities with a significant number of both Israeli Jews and Israeli Arabs including Akko (Acre), Haifa, Jaffa (the southern quarter of Tel Aviv), Ramla, and Lod

Programming toward Potential

Social Finance Israel & Developers Institute

Alla, a Russian graphic designer, made Aliyah in 2022 and wanted to become a programmer in order to maximize opportunity for employment in Israel. “I have always dreamed about working on projects that, with the help of hi-tech technologies, can better people’s lives.” Now she has that opportunity. Through Social Finance Israel’s unique Career Impact Bond, Olim Hadashim (new immigrants) and members of the Ethiopian community can train as programmers through a 9-month, full-stack boot camp at no cost. This Career Impact Bond is the first of its type in Israel and is an important program that builds economic independence and societal integration for new immigrants. Participants start paying back their tuition only after they start earning and only as long as they are earning enough to afford the repayment.

Social Finance Israel’s innovative loan program is designed to increase employment opportunities and promote upward social mobility for new and underrepresented Israeli populations.

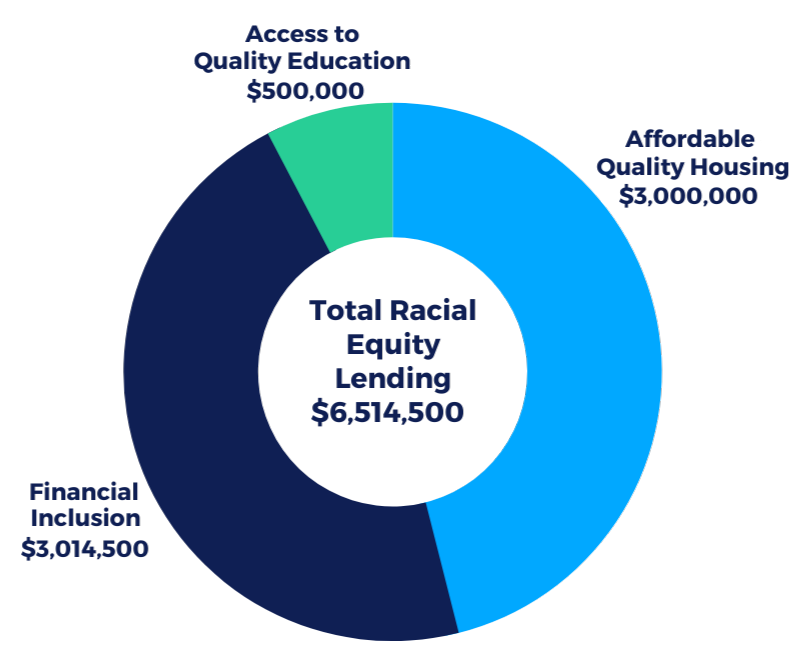

Investing in Racial Equity

An important part of the Federation’s work includes pursuing a more resilient, diverse world. Drawing from a deep Jewish tradition of social justice, many of our loans work to address the racial wealth gap and foster economic inclusion, particularly among marginalized groups.

Our impact loans reflect the Jewish values of tzedakah—giving with just intention; tikkun olam—healing the world; tzedek—pursuing justice; and kehillah—building community. Engaging in philanthropy that is expansive and inclusive reflects our commitment to positive change, both within and beyond the Jewish community.

“America has always had financial services deserts, places where it’s very difficult for people to get their hands on capital so they can, for example, start a business, but the pandemic has made these deserts even more inhospitable.”

-Treasury Secretary, Janet L. Yellen

Treasury to Invest $9 Billion in Minority Communities,

New York Times, March 4, 2021

Addressing Systemic Inequities in Financial Services

Small business entrepreneurship and home ownership are two primary wealth creators in the U.S. However, due to a history of biased lending practices, redlining, and racial discrimination in traditional financial services, these opportunities continue to be severely limited for underserved communities.

Creating Wealth, Jobs, and Community

Black Vision Fund

The Spice Suite in Washington, DC defied the pandemic, earning $1.5 million in revenue during 2020. However, while working with a bank to acquire commercial property, owner Angel Gregorio explains that the transaction was nearly lost. “City First Enterprises (a Black Vision Fund community lending partner) stepped in and held my hand throughout the process,” she said. “They saved the deal and got me to closing ahead of time.” CFE provided Gregorio with essential technical assistance, mentoring her on various aspects of the acquisition process. In addition to lending capital, the CFE Grants Management Team helped her with a grant application to the DC Commercial Property Acquisition Fund, allowing her to grow The Spice Suite while mitigating financial risk. The Spice Suite now doubles as a steppingstone for Black female entrepreneurs, each of whom sells handmade or specially sourced products through regular popups hosted by the store. “We’ve created jobs and a community around this business,” added Gregorio. “It’s been awesome.”

Racial discrimination in banking continues even though it’s against the law. The Black Vision Fund aims to give Black-owned businesses equitable access to capital and expertise which will help build long-term business success and wealth in Black communities.

Restoring the Freedom to Sell

Blackstar Stability

When most people hear “predatory lending” they think of interest rates, but these discriminatory practices also include contract-for-deed (“CFD”), and lease-to-own (“LTO”) agreements that leave low- and moderate-income families making home payments without holding the title to the property. Borrowers in Dayton, OH bought a home in 2013 and consistently made payments and substantial improvements to the home. With $69K of equity in the property, the couple considered selling the house to move for a job opportunity. They were stunned when the previous owner said they could not sell. They did not realize that their option to pay in full did not include the right to sell, lease, or transfer the property. Blackstar Stability worked with the couple to successfully refinance their home with a lower monthly payment and the freedom to sell if they wished.

Homeownership is key for building wealth and reducing the racial wealth gap. Blackstar Stability puts homeowners in underserved communities on a path to stable homeownership.

Bringing Black Representation to Toys

CNote

Despite being the fastest growing demographic of business owners, Women of Color continue to face significant barriers to success including discrimination, lack of funding, and lack of supportive business networks. These stumbling blocks didn’t deter Terri-Nichelle Bradley in her quest to start Brown Toy Box, an educational play-kit company that makes toys which get BIPOC* kids excited about STEAM** careers. After a series of pandemic setbacks, Terri-Nichelle landed a huge opportunity to sell nearly 40,000 of her play-kits to Target stores. However, she didn’t have the money to ramp up production and didn’t have enough revenue to qualify for a bank loan. She turned to Access to Capital for Entrepreneurs (ACE), a Community Development Financial Institution (CDFI).

CNote partners with CDFIs like ACE in communities across America, funding loans to small businesses, providing technical assistance, and empowering local entrepreneurs like Terri-Nichelle. “The reason that we are where we are right now is because we were able to get the capital. That happened because some really strong women in the investment and finance sectors showed up for me.”

Closing the wealth gap requires financial innovation. CNote facilitates investment in CDFIs which help investors earn returns while having a positive impact on businesses and communities across America.

* Black, Indigenous, and People of Color

** Science, technology, engineering, the arts, and math

Recycling Capital for Maximum Impact:

The Goldman Family

“Giving somebody a loan increases the chance that the funds are going to recycle and become available again for use in the future.”

For Jeff Goldman and his family, Jewish values of giving are most vividly brought to life during the Festival of Lights. “My wife and I sit down with our two kids every year and talk. It’s part of our Hanukkah conversations,” said Jeff. “I’ll say to the kids, ‘You each get to pick. Come up with a list of five organizations and pitch me on them.’ So, it becomes fun, but it’s also a way to engage them.”

Today, the Goldmans are utilizing their DAF to make both grants and loans in the Jewish community and beyond. They have wholeheartedly stepped into the Impact Lending Program with loans to three community lenders. They started with Hebrew Free Loan, which Jeff saw as a natural extension of his philanthropic support of the Jewish community. Then they expanded their impact lending with loans to the Black Vision Fund and Pacific Community Ventures. These two organizations align with the family’s vision of fostering economic development and empowering marginalized communities through philanthropy.

Additionally, Jeff loves that impact loans are often, quite literally, gifts that keep on giving, since funds are returned to DAFs at the end of the term to be used for further charitable purposes. He notes a critical distinction between a simple donation versus a loan. “Whether it gets repaid short term or long term, some recipients just don’t like the idea of a handout. Loans can feel more like a partnership.” Indeed, by partnering with the Federation, the Goldman family ensures that their support is representative of their values and a collective effort from the Jewish community as a whole.

Thanking Our Generous Lenders

We express our gratitude to all of the participants in our Impact Lending program to date.

Agger Fund

Aperture Fund

Arnheim Family Philanthropic Fund

Aron-Dine Family Fund

David Becker and Ann Peckenpaugh Becker Family Fund

Behar Family Fund

Berelson Family Philanthropic Fund

Berler Family Philanthropic Fund

The Blackstone Brody Philanthropic Fund

Josh Breuner Philanthropic Fund

Brill Family B Philanthropic Fund

Lynn Brinton and Daniel E. Cohn Philanthropic Fund

Marc and Ellen Brown Family Philanthropic Fund

Bulwik Family Philanthropic Fund

Madeline Chaleff and David Arfin Family Philanthropic Fund

Wendy Cohn Feldman Family Fund

Carla and David Crane Foundation

Eskenazi Family Philanthropic Fund

Richard Fiedotin Philanthropic Fund

Ganz Family Philanthropic Fund

Ilana T. Gauss Philanthropic Fund

Miriam and Arthur B. Gauss Philanthropic Fund

GoldKatz Family Fund

Grossman/Gerard Family Philanthropic Fund

Shelley and John Hebert Philanthropic Fund

Heeger Brothers’ Fund

James Heeger and Daryl Messinger Philanthropic Fund

Hershey Baer Fund

Stephen and Sonya Hurst Philanthropic Fund

Inspiration Fund

Frederick J. Isaac Philanthropic Fund

Jewish Community Federation and Endowment Fund

JL Charitable Fund

Kessler Family Foundation

King Family Fund

Michelle & Sue Kletter Family Fund

Joshua and Siobhan Korman Philanthropic Fund

Laura and Gary Lauder Philanthropic Fund

Melisse Leib Philanthropic Fund

Lenvin Fund

Leslie Philanthropic Fund

Libitzky Family Foundation Fund

Linker Family Philanthropic Fund

Connie and Bob Lurie Philanthropic Fund

Alexander M. & June L. Maisin Foundation

Dena Maple Philanthropic Fund

Jeanne Miller Giving Fund

Miller Family Fund

Moldaw Philanthropic Fund

Susan Moldaw Philanthropic Fund

Gale Mondry and Bruce Cohen Philanthropic Fund

Moss Family Charitable Fund

Robert and Jan Newman Philanthropic Fund

The Opaline Fund

Brian & Karen Perlman Philanthropic Fund

Julia and David Popowitz Philanthropic Fund

The Irving and Varda Rabin Foundation

David Rak and Oren Henry Family Fund

Randall-Musser Family Fund

Robbins Family Philanthropic Fund

Ronen Family Fund

Rothenberg Family Philanthropic Fund

Rubin Family Philanthropic Fund

Rob and Eileen Ruby Philanthropic Fund

Nancy and Ken Rudin Philanthropic Fund

Ellen and Gerald Saliman Philanthropic Fund

Harry and Carol Saal Family Fund

Jaclyn and Daniel Safier Family Fund

Sarnat-Hoffman Philanthropic Fund

Sarosi-Kanter Family Fund

David Saxe Philanthropic Fund

Jim and Emily Scheinman Family Philanthropic Fund

Mark Schneiderman and Adrian Hill Family Fund

Gary and Sue Schwartzman Family Tzedakah Fund

Sebago Philanthropic Fund

Gary and Dana Shapiro Philanthropic Fund

SheBeSki Fund

Sherman Family Foundation Philanthropic Fund

Stahl Family Fund

Stamper Family Philanthropic Fund

Steirman Family Philanthropic Fund

Philip & Cynthia Strause Philanthropic Fund

Paul and Susan Sugarman Family Philanthropic Fund

Sun Family America Fund

KM Tandowsky Family Fund

Ingrid D. Tauber Philanthropic Fund

Taxy Family Fund

Tikvah Philanthropic Fund

Tresenfeld-Waldrup Philanthropic Fund

Twin Oak Philanthropic Fund

H. and J. Ullman Philanthropic Fund

Wachter Family Philanthropic Fund

Waldman Family Philanthropic Fund

Kevin L. Waldman Philanthropic Fund

Rory and Jamie Weinstein Family Fund

Diane and Howard Zack Philanthropic Fund

Zubaty Family Fund

Learn more about open loan opportunities and the power of impact lending.